Sustainable Fund Asset Shrink Amid Weak Capital Market Performance

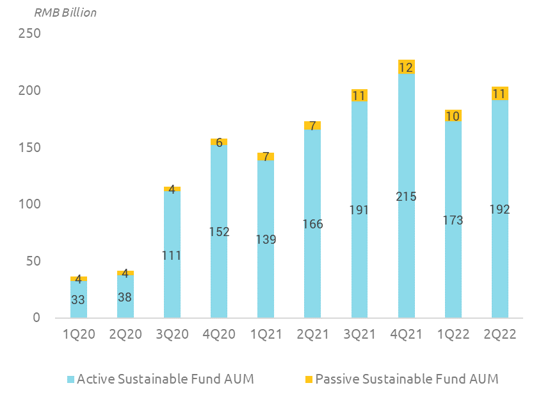

China’s sustainable funds[1] saw a decline in the total assets under management (AUM) in the first half of 2022, dropping 11% from the all-time record of RMB 227 billion at the end of 2021 to the current RMB 203 billion (roughly USD 30bn).

According to Morningstar's statistics on fund flows, China sustainable funds had net outflows of $1.4 billion in the second quarter of 2022, while in the first quarter, China sustainable funds still had net inflows of $200 million[2]. Carbon-neutrality and ESG themed investments were popular in 2021, resulting in a booming 56% increase in the AUM for China’s sustainable funds. The AUM drop and net outflow reflects the overall weak performance of the Chinese capital market and dampened investor confidence, which has been affected by the global recession, high inflationary pressures, and recurring cases of COVID-19 in financial hubs such as Shanghai and Shenzhen. In the 2nd quarter, the central government rolled out several stimulus packages to cushion the economic blow, and the AUM for sustainable funds also recovered 11%.

Figure: Total AUM of China’s Sustainable Funds, 2020—Q2 2022 (In RMB bn)

Active funds continue to retain the overwhelming share (94.4%) of the total AUM for sustainable Funds. The slow development of passive sustainable funds may be due to the lack of variety of ESG index products and the fact that market recognition still needs to be strengthened. But the deficiency is improving. In late July, the Shenzhen Stock Exchange released six ESG indices.[3] These six indices are ESG benchmark and ESG leading indices based on its core indices, namely Shenzhen Composite, SZ100 and ChiNext, which integrate ESG strategies of negative screening and positive screening respectively.

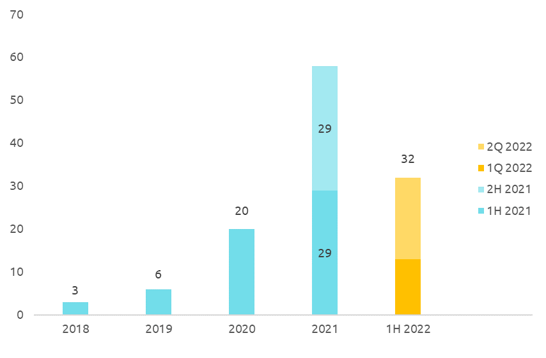

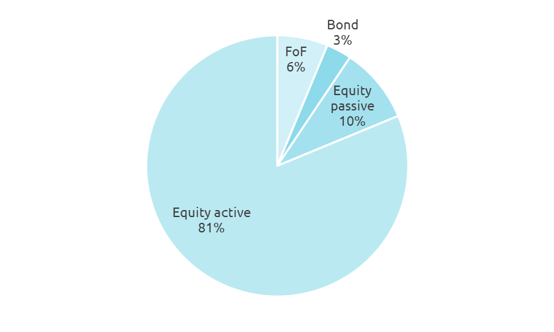

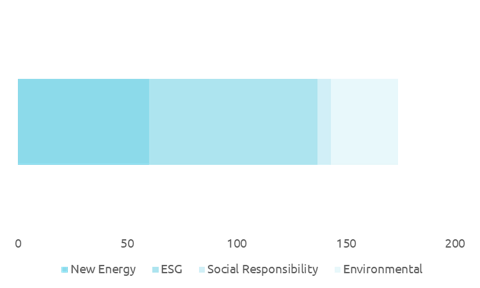

Despite shrinking fund assets, 1H2022 saw a steady growth in the numbers of newly-launched sustainable Funds. In 1H 2022, 32 sustainable funds were newly launched, which exceeded the 29 launches of 1H 2021. Active equity remains the most popular fund type among all new sustainable funds with over 80%, while passive equity (10%), FoF (6%), and bond funds (3%) make up a smaller share. Presently, the number of sustainable funds totals 174, which includes 77 labeled ESG, 60 labeled new energy, 31 labeled environmental, and 6 labeled social responsibility.

Figure: The Numbers of Newly Launched Sustainable Funds in China

Figure: Fund types of 1H 2022 Newly launched Sustainable Funds

Figure: The breakdown of sustainable funds by the thematic labels

For the second half of 2022, we believe the sustainable fund’s upward popularity trend will continue, as more and more institutional and individual investors in China incorporate SRI and ESG in their investment scheme, prompting asset managers to launch additional Sustainable fund products and repurpose existing conventional ones.

A recent notable development is the launching of a series of new carbon-neutrality ETFs in July from some of the country’s top asset management companies. These ETFs track the CSI SEEE Carbon Neutrality Index, which is compiled by the China Securities Index (CSI), Shanghai Environment and Energy Exchange (SEEE) and Shanghai Stock Exchange, among others. The index covers both key low-carbon industries such as photovoltaics, wind, battery, electrical equipment, utilities, as well as companies that have great potential for carbon reductions, such as chemicals, non-ferrous metals, construction materials, iron and steels, etc. The first batch of eight ETFs eventually raised over RMB 16 bn, or approximately USD 2.4 bn. [4]

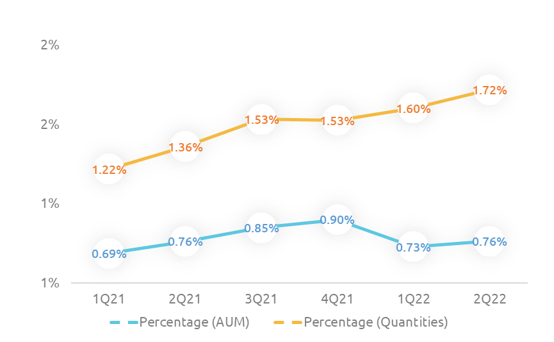

With these being said, the share of sustainable funds within all retail funds in China is still relatively low, in terms of number of funds and their AUM. According to iFinD, as of 1H2022, the percentage of the quantity and AUM of sustainable funds in all public funds was 1.72% and 0.76% respectively.

Figure: Percentage of the Quantity and AUM of Sustainable Funds in China

We expect this percentage to keep rising in subsequent quarters as investors' demand for strategies that align with their values and sustainability preferences continues to grow. China's share of sustainable funds is currently closer to that of its other Asian neighbors, such as Japan, but there is still more room for growth than in Europe, where sustainable funds are thriving. As a comparison, assets of the EU and Japan’s sustainable funds account for 0.6% and 18% of total fund assets in the EU and Japan capital markets, respectively.

Figure: Shares of Sustainable Fund Assets in China, Japan, and the EU (as of 1H22)

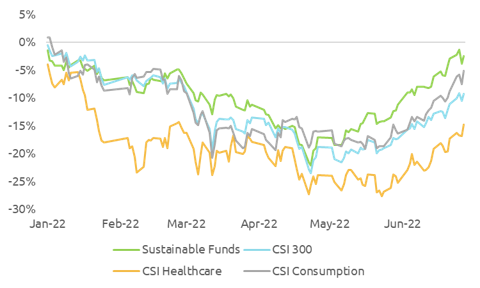

Sustainable Funds Recorded Modest Loss However Outperformed the Market

In the first half of 2022, the 174 sustainable funds recorded a -2.45% loss on average. In comparison, the overall stock market, represented by the CSI 300 index, dropped over 9% during the same time span. The performances of sustainable funds were also better than those of medical funds and consumption funds. The indexes of these two sectors recorded -14.72% and -5.06% respectively. In addition, sustainable funds were generally less volatile in 1H2022, and achieved a smaller drawdown during the steep fall of the market in Mid-March.

Figure: Sustainable Fund Performance in 1H22

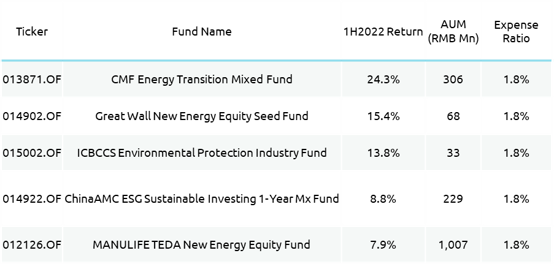

The top five performing sustainable funds in 1H22 all achieved returns of 8% and above. CMF Energy Transition Mixed Fund A, the top performer in the category, gained 24.3% in 1H2022, with an AUM of RMB 306 Mn and an expense ratio of 1.8%. In general, the energy transition/renewable thematic funds performed better than the other ESG integration strategies in 1H22.

Figure: The top five performing sustainable funds in 1H2022

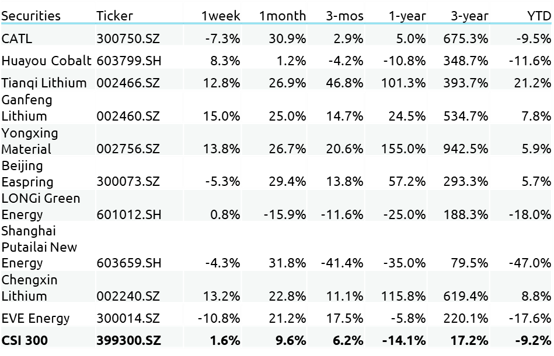

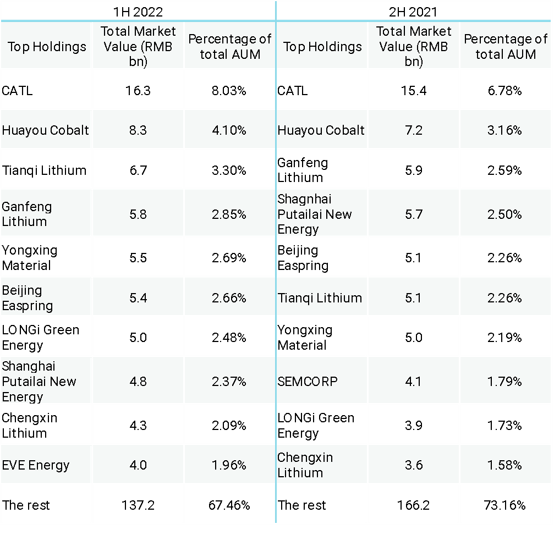

CATL(300750.SZ), Huayou Cobalt(603799.SH), and Tianqi Lithium(002466.SZ) were the top holding stocks for Sustainable funds by 1H2022. Reigning as world’s largest producer for lithium-ion batteries, CATL saw a big slide in its stock price in Q1, but it rallied over 30% in the second quarter due to surging demand from EV and energy storage installations, finally recording -9.5% in 1H2022. On the other hand, Tianqi Lithium (002466.SZ) significantly improved its profitability from the sky-rocketed price of lithium salt, gaining 21.2% on its stock price. In the top holding list, Ganfeng Lithium, Yongxing Special Materials, and Chengxin Lithium were also lithium mining companies that performed relatively well in the past two quarters.

Figure: Top holdings performance vs. CSI 300 (as of June 30, 2022)

Doubling Down on Sustainable Energy

Delving into the changes in stock and sector allocations of sustainable Funds in 1H22, we found that sustainable fund managers were increasing their positions on companies along the sustainable energy value chains. The top ten holdings are exclusively companies of renewable and battery industries and value chain giants. CATL is still the favorite, as fund managers hold more than RMB 16 bn worth of its stocks in 1H 22, or 8.03% of the total sustainable funds’ assets. The Chinese liquor giant Kweichow Moutai (600519.SH), despite not showing on the top 10 list in terms of total holding values, is named 39 times on the individual sustainable fund’s top 10 holding list in 1H22, which is a 77% increase to 2H21 (22 times). Overall, the sustainable funds’ portfolios are more concentrated than in 2H21, as the top 10 holdings account for 33% of total fund assets in 1H22, as opposed to 27% in 2H21.

Table: Top holding companies of China’s sustainable funds in 1H 2022 and 2H 2021

The funds’ sector allocations also demonstrate the trend of sustainable energy investment. Over half of the total fund assets is allocated in the power equipment sector, which are mainly composed of battery stocks, and non-ferrous metal sectors, specifically companies producing lithium, nickel, cobalt. There are also considerable changes in the rest of the sector allocations. Positions in the value sectors, such as food and beverage, chemicals, and banking are accumulated while positions in the electronics, healthcare, automotive, non-banking financial institutions, transportation and light manufacturing sectors were reduced in 1H 2022.

Table: Top holding sectors of China’s sustainable funds in 1H 2022 and 2H 2021