The European Parliament (EP) voted to advance legislative proposal for a carbon border adjustment mechanism (CBAM) regulation on June 22, along with the revision of the European Union (EU) Emission Trading System (EU ETS) and the Social Climate Fund. The European Parliament has been negotiating with the EU Council and the European Commission to finalize the bill.

Since the bill's debut in 2021, the legislative process for the CBAM has been full of twists and turns, and its provisions have been amended several times. This article will clarify the current situation with CBAM legislation development and explore, with a 12-question Q&A, potential outcomes that may raise concerns with investors and stakeholders.

1. What is the CBAM?

Formally known as the EU Carbon Border Adjustment Mechanism (CBAM), the CBAM is an additional tariff on the carbon emissions implicit in goods imported into the EU. In other words, the CBAM achieves "carbon price parity" by regulating the difference in the pricings of carbon emissions contained in goods within and outside the EU border.

2. Why is the EU actively promoting the CBAM?

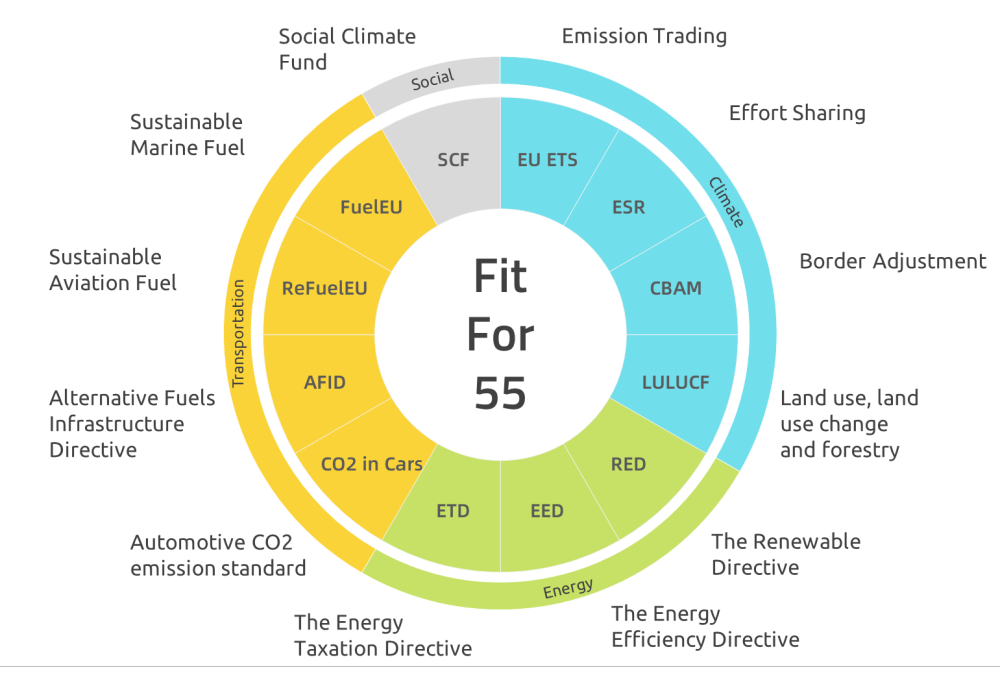

The EU has long seen itself as a global leader in the fight against climate change and has recently led a series of new climate policies. Last July, the European Commission announced its Fit for 55 package. The name "Fit for 55" comes from the EU's plans to reduce the EU's net greenhouse gas emissions by at least 55% by 2030 as compared to 1990 and to achieve carbon neutrality by 2050. The climate package aims to make the EU's climate policy more binding and to accelerate the EU's decarbonization progress.

Figure:Overview of Fit for 55 climate package

The CBAM proposal is a central part of the Fit for 55 package and introduces improvements to the current EU emission trading system (EU ETS). According to the EU, the CBAM is intended to address the issue of carbon leakage in the process of enforcing its emissions reduction targets. Carbon leakage means that for countries or regions that strictly implement carbon reduction plans (such as the EU), their regional production activities (especially energy-intensive products) may be transferred to other countries or regions that do not take strict carbon reduction measures. Carbon leakage results in EU countries reducing domestic carbon emissions while carbon emissions from imported goods are increasing and are offsetting the EU's efforts to reduce greenhouse gas emissions. The CBAM can help reduce carbon leakage by enforcing taxes on imported high-carbon products and equalizing the cost of carbon emission in products within and outside the EU.

The CBAM also serves as a protection against the loss of competitiveness of EU companies due to high carbon prices. Since 2021, the EU ETS has entered Phase 4, where free allocations will gradually phase out for sectors less exposed to carbon leakage and a 2.2% annual decline ratio of union-wide emission cap will replace the 1.74% in Phase 3. Reflecting the more stringent allocation change, the EU carbon price surged from below EUR 20 to above EUR 90 and has remained at around EUR 80 over the past two years. To compensate for the cost pressure for many EU enterprises, especially those of energy-intensive industries, the bloc could impose carbon cost differences on imports. We believe that this is also one of the main reasons why the EU proposes the CBAM at this point in time.

3. Where are we in the legislative process of the CBAM? And how far away are we from official launch?

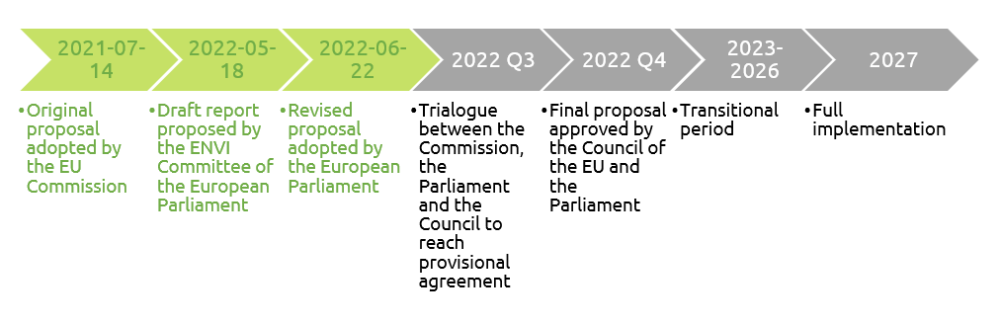

The concept of the CBAM was introduced as early as 2019, when European Commission President Ursula von der Leyen unveiled the European Green Deal. In July 2021, the European Commission announced the Fit for 55 package, which includes the first version of the CBAM legislative proposal.

Under the EU's ordinary legislative procedure, a new bill needs to be reviewed and voted on by both the European Parliament and the Council of the EU. In the European Parliament, the Committee on the Environment, Public Health, and Food Safety (or “ENVI”) is responsible for the legislative work of the climate package. In May 2022, the committee adopted a revised CBAM proposal, and the European Parliament took its first vote on June 8; however, MEPs did not agree on the timing of the expiration of free carbon allowances in the carbon market reform legislation, and the vote on the CBAM was cancelled. At the plenary session of the Parliament on June 22, the amendment to the CBAM was finally passed with 450 votes in favor, 115 votes against, and 55 abstentions.

After the voting process in the Parliament, the CBAM proposal has had to go through a series of procedures in the EU Council which represent the interests of the EU member states. Given the divergent views between member states and the European Parliament, the next legislative process for the CBAM is expected to take between six to eight months, according to sources, meaning that the final text may not be approved and published until the end of 2022. According to the timeline mentioned in the latest proposal, the CBAM will likely enter pilot implementation as early as January 2023, once it has passed and has become law.

Figure: Timeline for CBAM legislative procedures

4. Are all exporting countries subject to the CBAM?

CBAM exempts non-EU countries that have joined the EU ETS or are linked to the EU carbon market, and even these countries must have imposed a carbon price on the goods. The CBAM does not apply to imports originating in Iceland, Liechtenstein, Norway, Switzerland, and the five EU overseas territories. Of these, Switzerland is already connected to the EU carbon market, and Iceland, Liechtenstein, and Norway have joined the EU carbon market. The proposal does not give special treatment to developing countries and least developed countries.

5. What goods and sectors are covered by the CBAM?

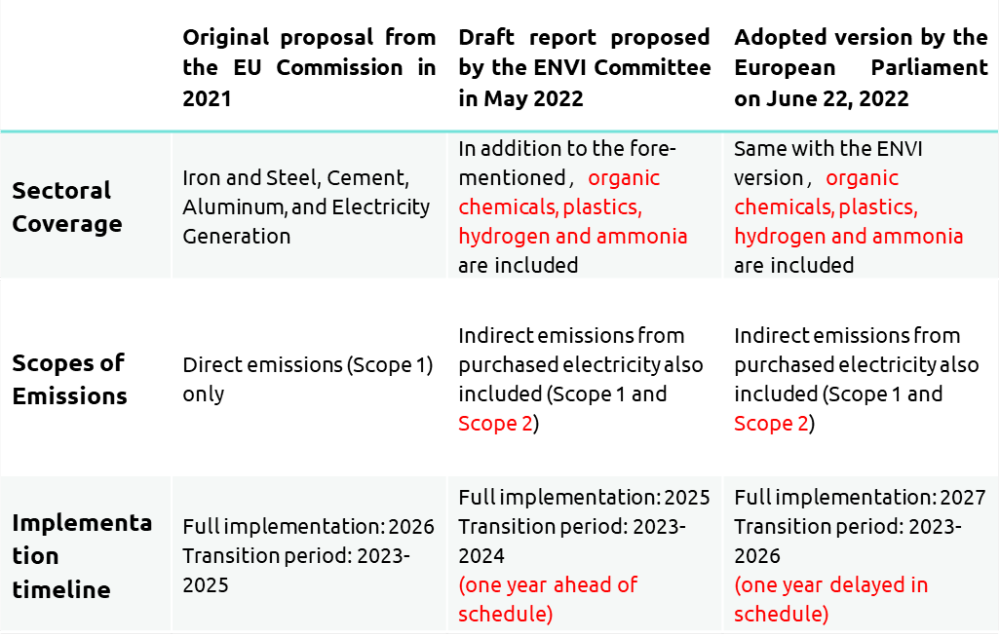

According to the first legislative proposal of the European Commission, the initial sectors covered by the CBAM are the following five industries: electricity, iron and steel, cement, aluminum, and fertilizer. In the ENVI Committee’s revised proposal, organic chemicals, plastics, hydrogen, and ammonia products will also be covered. On June 22, the European Parliament adopted the ENVI Committee’s version of the proposal.

6. What scopes of emissions are accounted for in the CBAM?

In the initial proposal, the CBAM applied to greenhouse gas emissions directly generated by the covered imported goods during their production and manufacturing process. Such a definition is consistent with Scope 1 carbon emissions. The proposal published by the ENVI Committee goes a step further by including indirect emissions in the calculation—Scope 2 emissions such as carbon emissions included in purchased electricity in the production process. On June 22, the European Parliament adopted the ENVI Committee's version of the proposal.

7. If the CBAM is approved, what is the implementation schedule?

According to the proposal adopted by the European Parliament on June 22, the CBAM will be formally implemented in 2027, with a buffer transition period from 2023-2026—a timeline that is one year longer overall than the initially proposed by the European Commission. In contrast, the proposal of the ENVI Committee a month ago put forward a formal implementation date of 2025.

We have compared side-by-side the three versions of the proposal: the initial proposal of the European Commission, the revised proposal of the ENVI Committee, and the proposal adopted by the European Parliament. The key points are summarized below.

Figure: Key points of the three version of CBAM proposal

The latest adopted version further expands the sectoral coverage and emission scopes of the CBAM, with MEPs compromising on the postponement of the implementation time. This reflects the high expectations within the EU for the CBAM in terms of preventing carbon leakage, as the delay in implementation provides more time for stakeholders to address the potential impacts of the CBAM.

8. How will the carbon emissions of imported goods be measured?

In the CBAM proposal, imported products are characterized as either simple goods or complex goods, and carbon emissions are measured in different ways.

Simple Goods: Products that are manufactured using only materials and fuels with zero implicit carbon emissions, such as products processed directly from materials found in nature. Examples of such primary goods are food, beverages, tobacco, and fossil fuels. The carbon emissions of simple goods are the total direct and indirect emissions from their production processes.

Complex Goods: Products that require simple products as feedstock in the manufacturing process, or industrial products in general. The carbon emissions of complex goods are the sum of the carbon emissions of the production process and the implied emissions of the simple products consumed.

If the actual emissions cannot be determined by the abovementioned ways, they are then estimated by the following methods in turn:

- The default value of the average emission intensity of the exporting country.

- If reliable emission intensity data for the exporting country is not available, the average emission intensity of the worst performing 10% of the EU is taken as the default value for the calculation.

The EU has not yet made detailed rules on the specific calculation of implied emissions, specific emission range boundaries, and other issues, which are to be issued pending the release of further implementation rules.

9. To what extent will China's trade with the EU be affected by the introduction of the CBAM?

China and the EU are very important trading partners for each other. Currently, China is the EU's top trading partner, and the EU is China's second largest trading partner after ASEAN. In 2021, China's exports to the EU amounted to RMB 3,348 billion, up 23.7% YoY, accounting for about 15% of China's total exports and about 25% of the EU's total imports. China's exports to the EU are mainly concentrated in the sectors of mechanical and electrical products, textiles, metal goods, and chemicals, with machinery and vehicles accounting for 52% of the total.

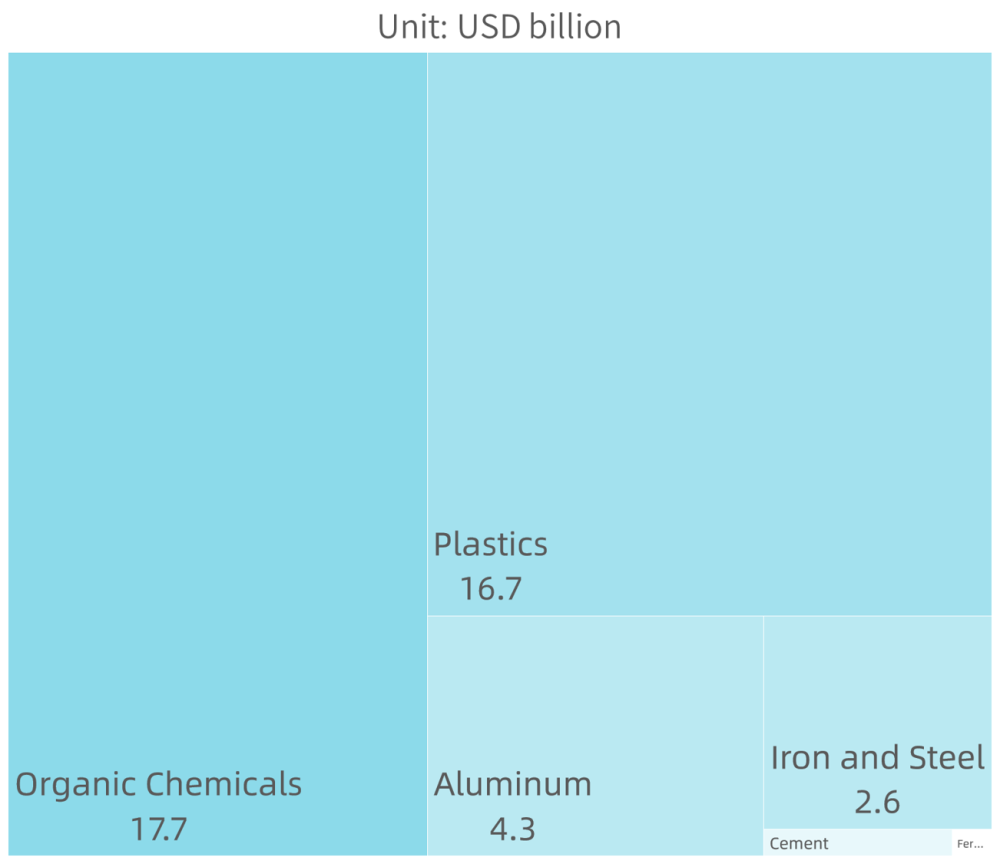

The impact of the CBAM on China-EU trade will largely depend on the number of industries covered in the final legislation. According to the initial version of the European Commission, which covers the steel, aluminum, cement, and fertilizer industries, the annual exports involved in these products amount to about $7 billion per year, accounting for less than 1.3% of China's total exports to the EU. Of these, Chinese exports of steel and aluminum to the EU amount to $2.5 billion and $4.2 billion, respectively, while trade in cement and fertilizer is relatively trivial.

However, aligning with the version of the proposal adopted by the European Parliament, which would include organic chemicals, plastics, hydrogen and ammonia in addition to the four aforementioned sectors, the export value of all related products increases significantly to $41 billion, or 7.4% of China's total exports to the EU in 2021. The significant increase mainly comes from organic chemicals and plastics, both of which account for $17.7 billion and $16.7 billion of China's exports to Europe in 2021, respectively.

Figure: China to EU exporting value of industries covered by CBAM in 2021 (USD billion)

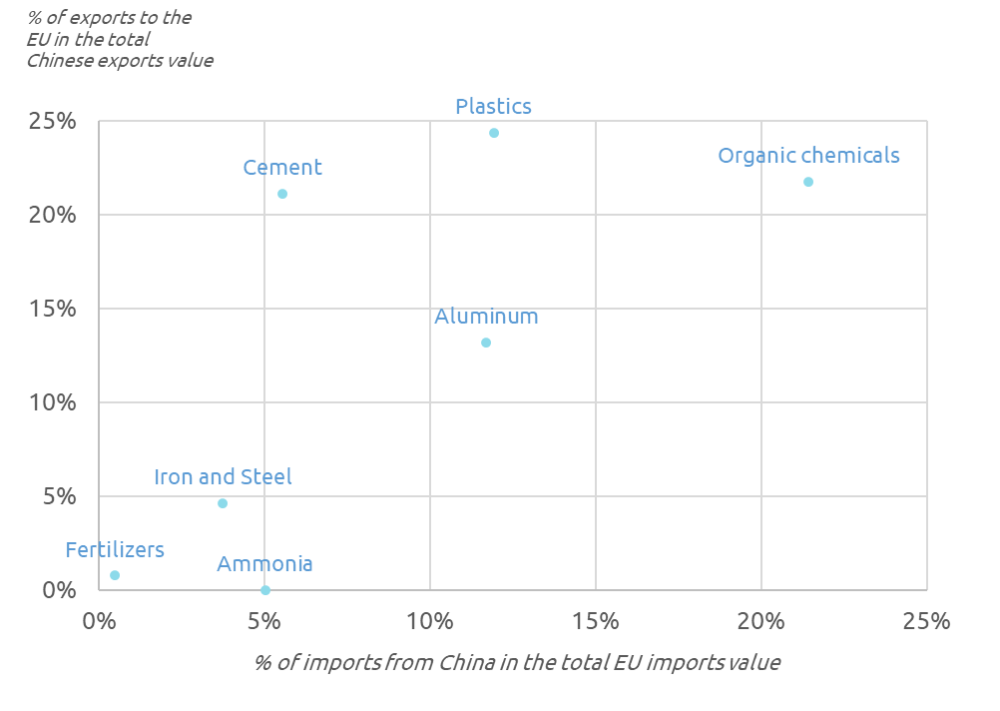

To further reveal the potential impact of the CBAM on these industries and supply chains, we have calculated the percentage of products from Chinese sellers in total EU imports and the percentage of exports to the EU in total Chinese exports in these industries in terms of trade value. These two sets of data provide an intuitive representation of the extent of the impact of the CBAM on EU downstream buyers and on Chinese upstream suppliers, respectively. In addition, we performed an analysis of the two data sets as continuous variables; the results are shown in the figure below.

Figure: The share of the Sino-EU trade value of seven industries that may be applicable to the CBAM in China’s total export and the EU’s total import trade value

Fertilizers, iron and steel, and ammonia are shown in the lower left corner of the chart, which means that the CBAM has a limited impact on the supply chains of these three industries, both for EU importers and Chinese exporters. For the EU, goods from Chinese sellers account for more than 20% of their total imports in their cement, plastics, and organic chemicals industries, and, therefore, CBAM is likely to have a larger impact on downstream manufacturers in these industries of the EU economy. For China, the EU is an important market for organic chemicals, plastics, and aluminum (exports to the EU account for more than 10% of total exports). The potential market risk for these three related industries warrants the attention of the Chinese suppliers.

Moreover, the potential impact of the CBAM is not limited to bilateral trade. The CBAM is widely applied to countries around the world; for example, it will affect not only China, but also Russia, Turkey, and other countries that export a large amount of steel, fertilizer, and chemicals to the EU. The competitiveness of China's exports is likely to improve if the country's relevant industries adopt more aggressive low-carbon transition measures, so that carbon emissions contained in similar products are lower than the rest of the exporting countries to the EU.

10. How much will the CBAM increase the tax burden on goods from China?

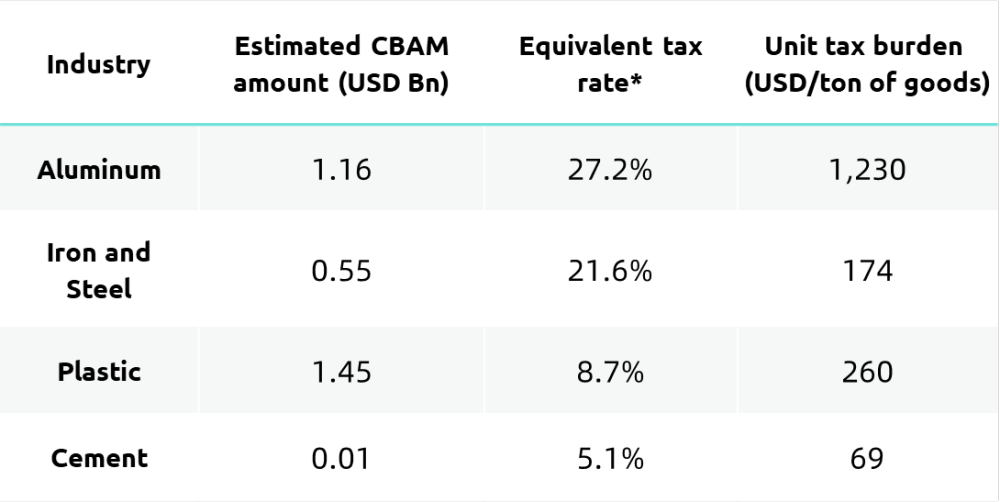

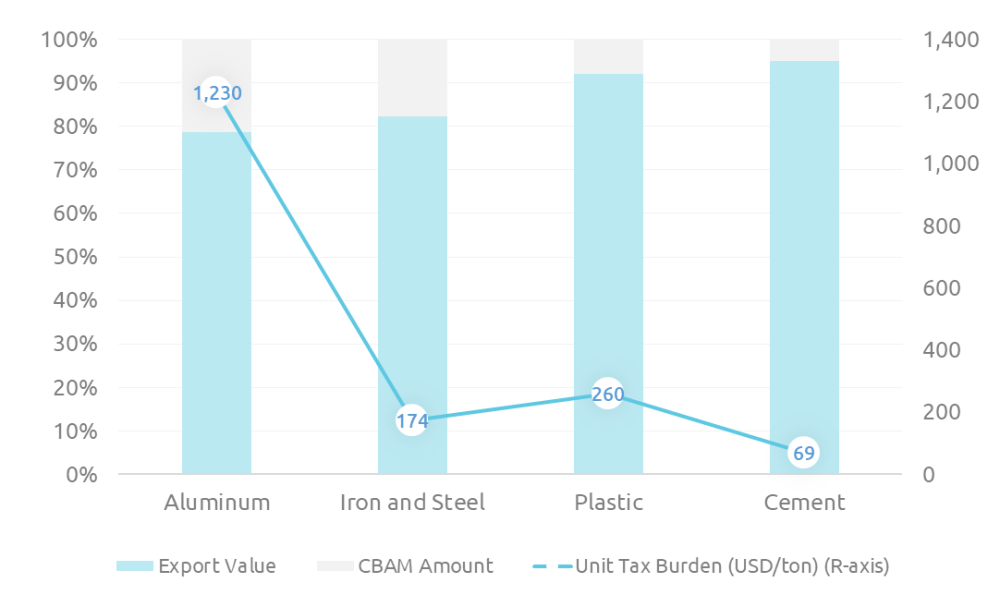

In short, the CBAM would make up the carbon price difference between the EU and the importing country in terms of the implied carbon emissions of the product. To quantitatively demonstrate the potential impact of the CBAM on relevant industries in China, we have estimated the tax burden for the plastics, aluminum, cement, and steel industries under a baseline scenario (organic chemicals, fertilizers and ammonia industries are not calculated due to both difficulty in estimating carbon emissions and very limited impact). The results are shown in the table below.

Table: CBAM tax burden of aluminum, steel, plastics, and cement under the baseline scenario

Aluminum production consumes a large amount of electricity and results in high carbon emissions. Based on our calculations, China's aluminum exports could be subject to a CBAM amount as high as $1.16 billion, with unit tax burden of $1,230 per ton of aluminum and equivalent tax rate of 27.2%, both of which are the highest among all CBAM covered industries. The unit tax burden of steel is much lower ($174 per ton), but due to the relatively low unit value of steel products, its equivalent tax rate exceeds 20% as well. Plastic products have the highest CBAM burden of USD 14.5 billion, but the equivalent tax rate is relatively low due to its high unit value. The cement industry has a low trade volume and CBAM tax burden and is therefore minimally affected.

Figure: The CBAM’s estimated influence on aluminum, steel, plastic, and cement

Based on the above quantitative estimates of CBAM burden and the importance of trade in individual commodities between China and Europe for both economies, we believe that the introduction of CBAM will have a significant impact on the aluminium value chain in China and Europe. Stakeholders, including enterprises along the aluminium value chain and regulators from both economies, need to sit down and discuss the possible outcome.

China's plastics, steel, and organic chemicals industries will also be affected to some extent. Considering the energy intensiveness of these industries in general, we suggest that the affected relevant business entities and industry organizations also conduct studies on the CBAM and find ways to reduce exposure to the CBAM.

11. Is there any loophole in the CBAM?

The main purpose of the CBAM is to prevent carbon leakage; however, some experts point out that although it prevents explicit carbon leakage within the bloc, CBAM may also lead to changes in international trade flows that, in essence, fail the purpose of preventing carbon leakage. We cite the following two examples to illustrate this:

- For businesses exporting to the EU, EU CBAM implies additional tariffs. Therefore, the market impact of EU CBAM on exporters may reduce sales of products to the EU and instead increase sales to non-EU countries, or export semi-finished products to the EU so that exporters are not affected by CBAM. This is similar to tax planning, where companies can always find a way to legally achieve the lowest cost of tax burden (in the case of the CBAM, the lowest cost is also the lowest carbon price) within a given framework—by re-exporting, for example. This in itself can be considered as a form of carbon leakage.

- In addition, the CBAM will also lead to an increase in the cost of feedstock materials for downstream manufacturers in the EU, which will make products from the EU ultimately more expensive. For example, in China, the subsequent market effect will make goods produced and sold locally more competitive in the domestic market. As a result, China's carbon emissions may increase with the expansion of local production. At the same time, Chinese producers would begin to import raw materials from low-carbon-priced countries to offset additional domestic emissions, and carbon leakage will therefore continue to occur.

12. What are the potential impacts of CBAM on China's carbon policies?

Since the CBAM essentially charges the carbon pricing difference included in the production of homogenized products, reducing exposure to the CBAM in the long term therefore requires a fundamental low-carbon transition and a reduction in carbon emissions from domestically produced goods in China. While the EU is actively pushing for CBAM legislation to come into effect, we believe that China's related carbon policies will also be aligned with the country’s interests and ambitions in global climate politics.

- Emission cap-and-trade system is expected to play a central role in the country’s intention to promote explicit carbon pricing

As of June 20, the price of carbon allowance in the EU ETS market is EUR 82.37/ton, while the average price of China's counterpart barely reaches RMB 60/ton and only covers the thermal power industry. It can be said that the carbon market mechanism does not play a big role in the country’s decarbonization progress at present. The government relies more on other administrative means, such as controls on total energy consumption and energy intensity, renewable energy subsidies, and standard setting to achieve emission reduction equivalent to the effect of cap-and-trade mechanism. However, it is difficult to convert the implicit carbon pricing of these administrative instruments into explicit pricing, and they cannot be exempted by the EU.

Therefore, we believe that the implementation of the CBAM in the EU is expected to prompt China’s regulatory authorities to pay more attention to explicit carbon pricing and build the carbon cap-and-trade system into the core mechanism of domestic carbon pricing, with broader sectoral coverages in the foreseeable future.

- More active guidance is needed to strategically decarbonize industry enterprisesBy guiding enterprises to accelerate decarbonization and develop appropriate emission reduction paths, the country’s economy can better adapt to the future development trend of green trade and avoid being taxed for high carbon emissions in its product exports.

Published in October 2021, the State Council's Action Plan for Carbon Peaking by 2030 has made top-level design for the decarbonization of key industries such as iron and steel, non-ferrous metals, building materials, and petrochemicals. Subsequently, in February 2022, NDRC issued the Implementation Guide for Energy Saving and Carbon Reduction Transformation and Upgrading in Key Areas of High Energy-Consuming Industries (2022 Edition) to guide energy saving and carbon reduction transformation in energy-intensive industries. We expect that an overall guiding document for the carbon peaking and carbon neutrality of the industrial sector will be officially issued in mid to late 2022. For each individual key industry such as iron and steel, non-ferrous metals, building materials, chemicals and petrochemicals, carbon peaking action plan drafts are also expected by the end of 2022.