China's electric vehicle (EV) market has delivered an upbeat performance in the first half of 2022, despite shutdowns and sales disruptions due to the pandemic, rising prices, and supply shortages of upstream raw materials as a result of global inflation and the Russia-Ukraine conflict.

EV’s accelerating growth in shrinking auto market

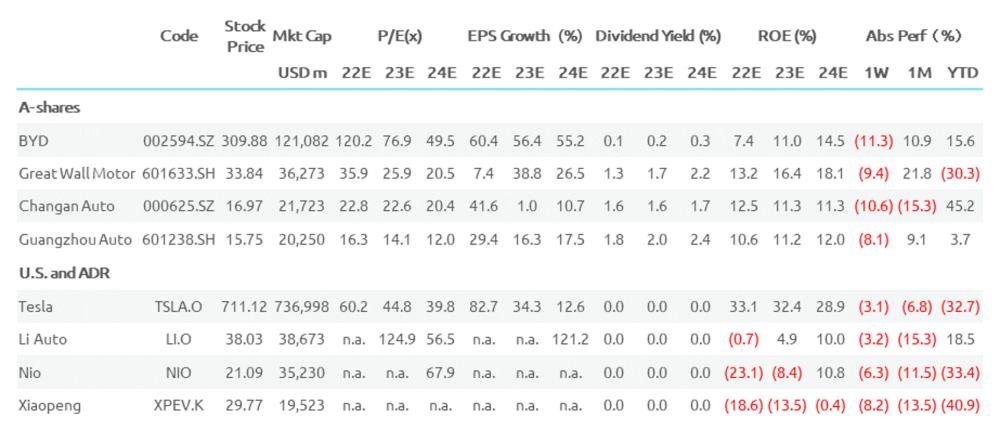

According to China Association of Automobile Manufacturers (CAAM) statistics, China's EV market totaled 2.6 million in retail sales in the first half of 2022, an increase of 120% YoY. At the end of June 2022, there are a total of 10.1 million EVs in China, of which 8.1 million are battery-powered electric vehicles (BEVs), accounting for 81% of the total.

It is worth noting that the rapid growth of EV sales is achieved against the backdrop of a shrinking auto market as EVs are accelerating to replace conventional fuel vehicles in China’s market. In contrast to EV’s, the overall sales of the Chinese auto market are 12.1 million units for 2022H1, down 6.6% YoY.

Chart: EV vs. Traditional fuel vehicles sales and EV penetration rate in China’s market, 2020 to 2022H1

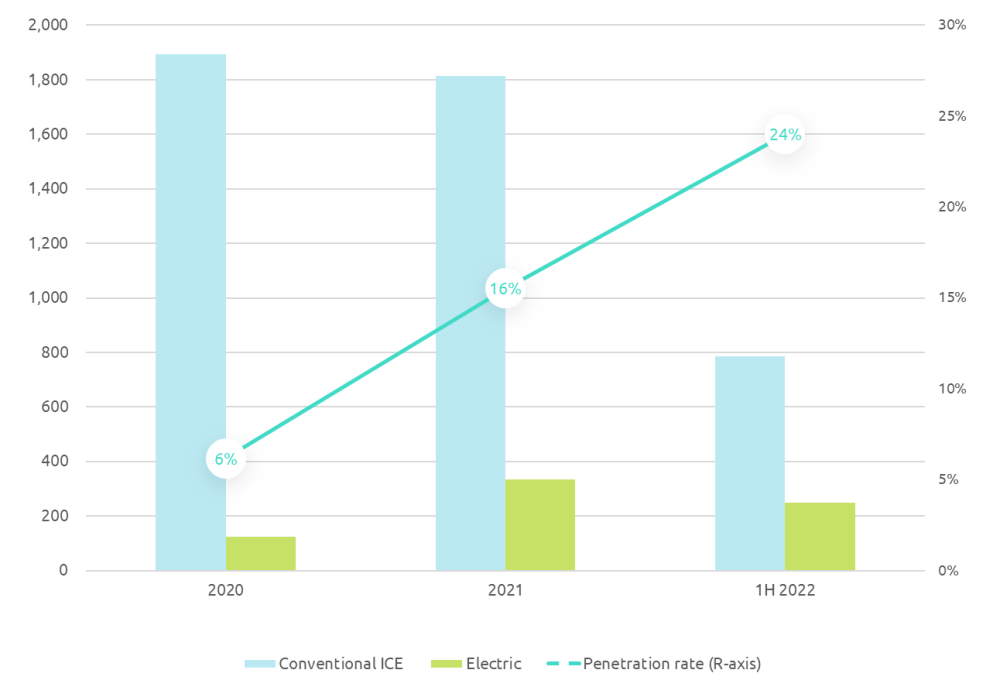

Another notable trend of the EV transition was EV’s rapid entry into lower tier cities in China, where there are no government-imposed purchase restrictions for conventional vehicles. In the past six months, EV’s penetration rate in these cities has almost doubled from 11.2% in FY21 to 20.3%.

The higher EV sales are driven by both rising cost of operating a fuel vehicle vs. the replacement cost of an EV. The rising oil prices have shaken the willingness of cost-sensitive consumers while EV manufacturers are continuously launching new products to cover more price ranges and target groups, including more price sensitive groups.

Chart: Penetration rates of EV in cities with or without purchase restrictions, 2019-2022H1

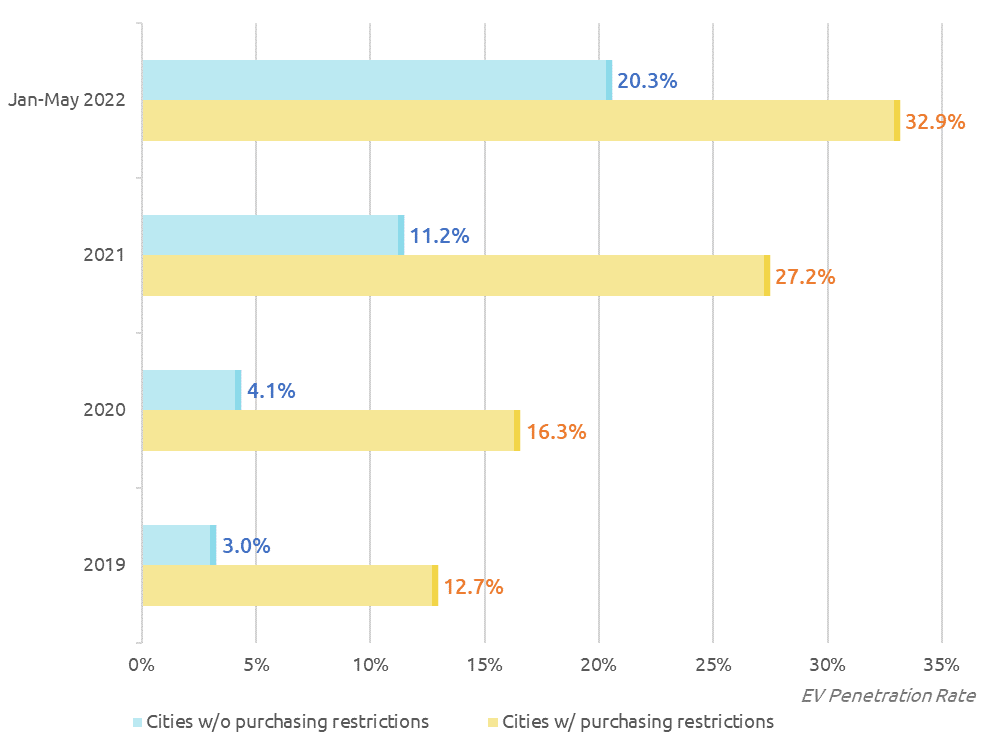

Strong sales growth bring higher share price

The Chinese capital market showed increasing enthusiasm for EV’s growth potential backed by growing consumer demand and government’s continuous support.

BYD (002594.SZ), Chang’an Automobile (000625.SZ) and Li Auto (LI.O) all recorded strong sales performance, up 24%, 46% and 18% respectively in1H22, significantly outperforming the CSI 300 (-8.8%) and Nasdaq Composite (-30%) over the same period. In the rally period from late April to late June, Chang’an Automobile and BYD's share prices rose 149% and 44%, respectively, and both also hit new historical highs since their IPOs.

On the other hand, Great Wall Motor (601633.SH), Nio (NIO) and Xiaopeng (XPEV.K), which have seen relatively lower sales growth, have underperformed, falling 22%, 35% and 37% over the same period. Tesla (TSLA), which saw its share price outperform last year but was hit hard in 1H22 by doubts about its slowing capacity ramp-up and Covid-related supply chain management, fell 44% in the first half of this year.

Overall, the CSI New Energy Vehicle Industry Index (CSI 930997), which covers A-share companies in the EV, lithium-ion battery, and related value chains, rose 2.1% in 1H22, outperforming the CSI 300 index by 11% over the same period.

Chart: Performance of selected EV company stocks, H1 2022

Competitive landscape: New players chasing Tesla

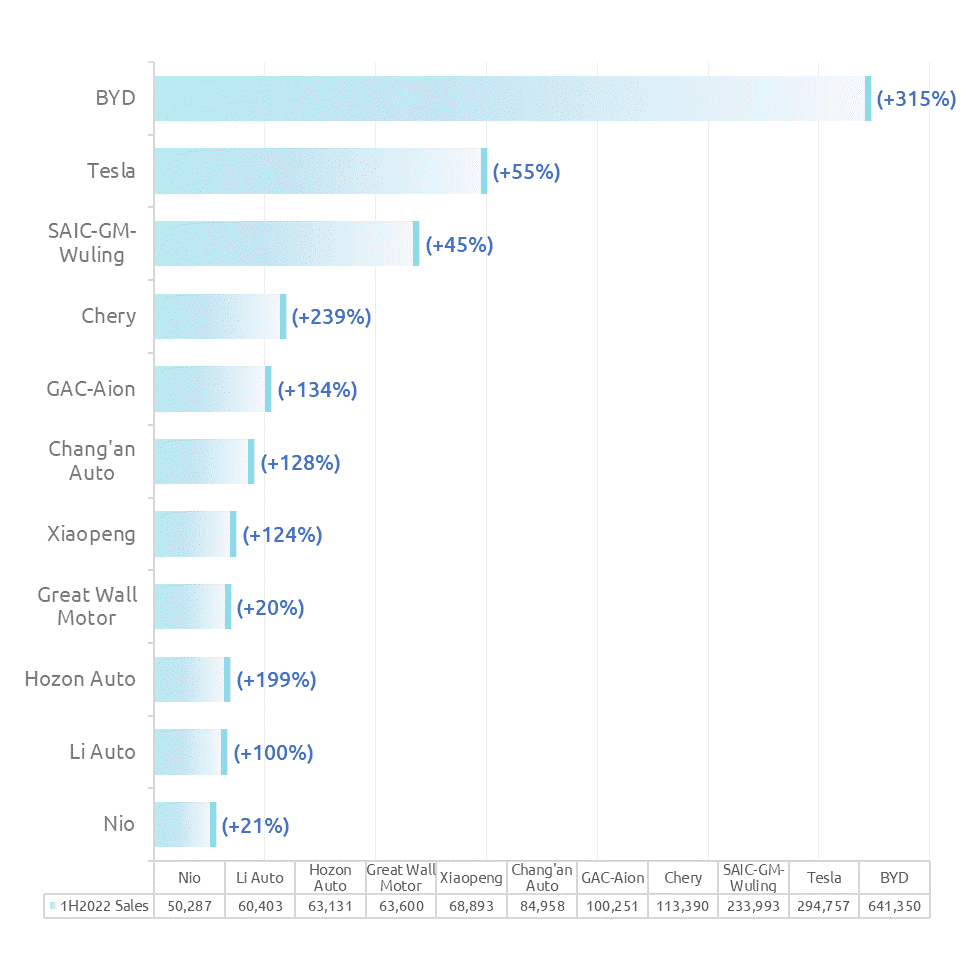

The competitive landscape among new energy vehicle companies is also quietly changing, with BYD’s sales are at the top, Tesla is undergoing a slowdown in growth and expansion, and a group of new players are chasing behind.

According to data released by BYD (002594.SZ), the cumulative sales of new energy vehicles in the first half of 2022 was about 641,400 cars, a YoY increase of 314%. This compared with Tesla (TSLA)’s worldwide delivery total of 564,000 electric vehicles in the first half of 2022. These sales ]\ it the global EV sales champion, beating Tesla by 80,000 in unit sales. SAIC-GM-Wuling maintained its top three market sales by relying on its best-selling low priced MINI EV model. Other EV companies including Chery, GAC, Xpeng, NeZha, and Li Auto all achieved a year-on-year increase of more than 100%. Meanwhile, NIO and Great Wall Motor’s 20% sales growth seems a little behind the competition.

Chart: New energy vehicle sales volume and growth rate in the Chinese market, 2022H1

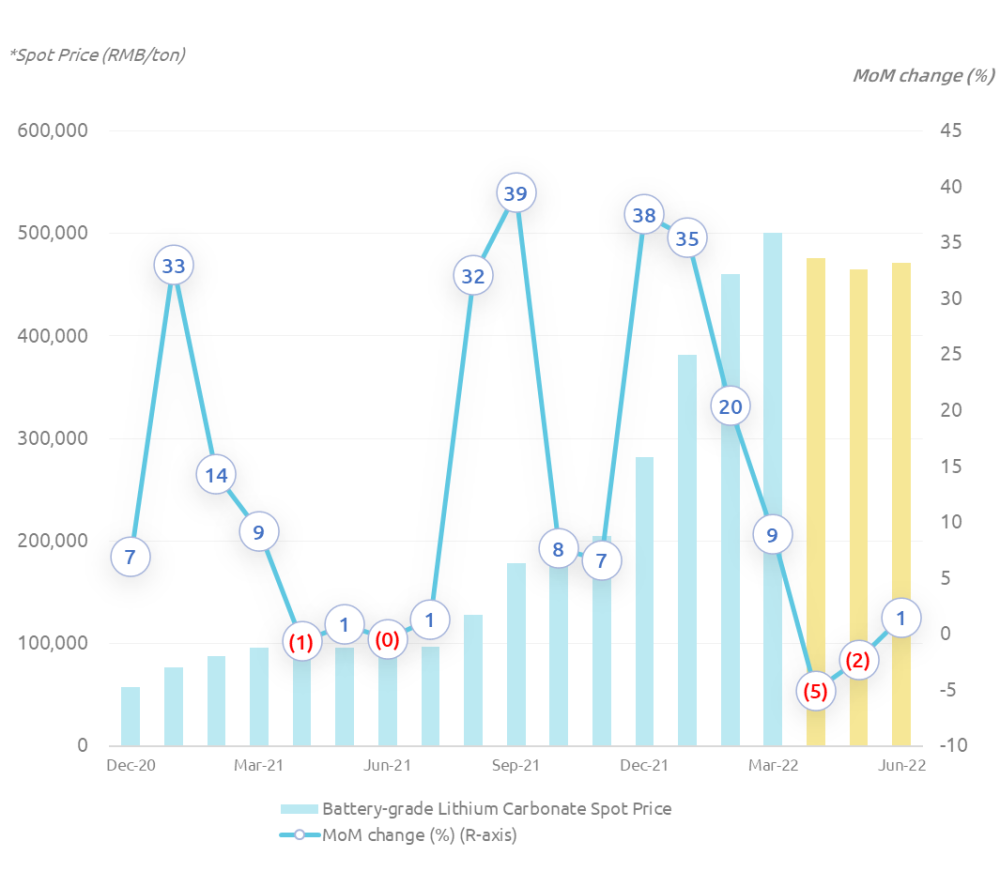

Supply shortage and demand growth prop up lithium prices

"Price increase" and "supply chain" have become the key words for new energy vehicle companies in the past six months. In our April report, "Behind EV Price Hike in China: Unprecedented Price Spikes of Lithium and Lithium Salts", we pointed out that since 2021, the rapid growth of new energy vehicle consumption has led to a shortage of batteries and other core upstream materials.

The large demand-supply gap has caused the prices of metal Lithium and LiPF6 in electrolytes to increase by several folds. We also pointed out that because of the strong demand growth and the inability of lithium mining supply to keep up, the gap in the supply and demand of lithium salt will continue. This gap would cause lithium price to remain high in the foreseeable future. As it turns out, in April, the price of battery-grade lithium carbonate briefly dropped by 5%, from RMB 500,000 per ton to around RMB 470,000 per ton and has remained high since.

Chart: Spot price and annual growth rate of battery-grade lithium carbonate, as of 1H2022

During the first half of 2022, materials such as aluminum alloy used in the lightweight frames and copper used in motor systems rose with the global inflation. Automotive-grade chips are still in short supply.

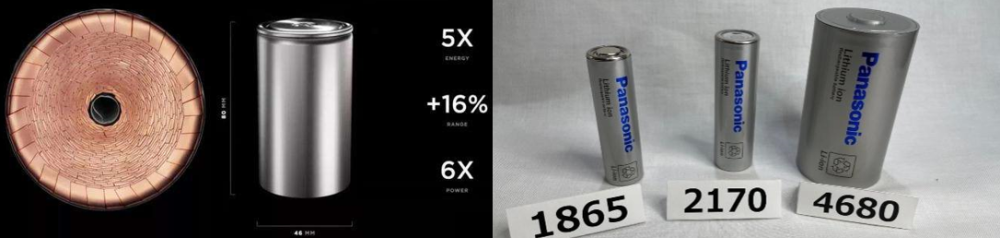

Tesla vs. BYD – the battery war

Tesla’s reliance on third-party supply of batteries has also constrained its production capacity expansion. At the 2020 "Battery Day", Elon Musk announced Tesla’s next generation battery technology–4680 battery, named after a larger single battery size (a cylindrical battery with a diameter of 46mm and a height of 80mm) that is designed to provide higher energy density while reducing production costs.

In Tesla's proposed timeline, the 4680 battery was supposed to be ready for mass production in September 2021 but was delayed by the main supplier Panasonic by a series of difficulties in ramping up production capacity and low yield rate. The 4680 battery was eventually installed on Tesla's Model Y in June 2022. (Currently manufactured by Tesla's Austin Gigafactory, and the battery carried in this model is found to be manufactured in Tesla's Kato facility in California).

Based on the current over 6-months delivery delay on Model Y in the US, it can be easily inferred that its own facility cannot meet the company’s demand for batteries. Tesla still heavily relies on third-party suppliers such as Panasonic, CATL and LG. Panasonic said that it has started small-scale trial production of 4680 battery cells in May this year and aims for mass production in April 2023. By that time, it will be able to supply an annual capacity of around 10GWh. In addition, Tesla is also looking for new battery partners. In early June, it was reported that BYD will provide battery products for Tesla.

On the other hand, BYD does not have to worry about its battery supply chain. Started with batteries manufacturing, BYD has independent battery research and development and production capabilities. The expansion of its battery production capacity is also very aggressive. According to statistics, by the end of 2021, BYD's battery production capacity reached 135GWh, and it is expected to reach 285GWh by the end of this year, making it the second largest Chinese battery producer behind CATL.

In fact, BYD is currently the world's largest manufacturer in producing lithium iron phosphate (LFP) battery. In addition to supplying its own needs, excessive production capacity in the LFP lithium-ion battery packs have enabled the company to export its blade battery products to other EV companies and energy storage companies.

Moreover, BYD's sister company Youngy Group has grown into a comprehensive business layout on battery material manufacturing and lithium mining. As a result, the production capacity ramp-up of BYD was faster than ever in the first half of this year, far exceeding that of Tesla. However, in the case of revenue growth driven by sales growth, increasing profits may become a more urgent goal for BYD.

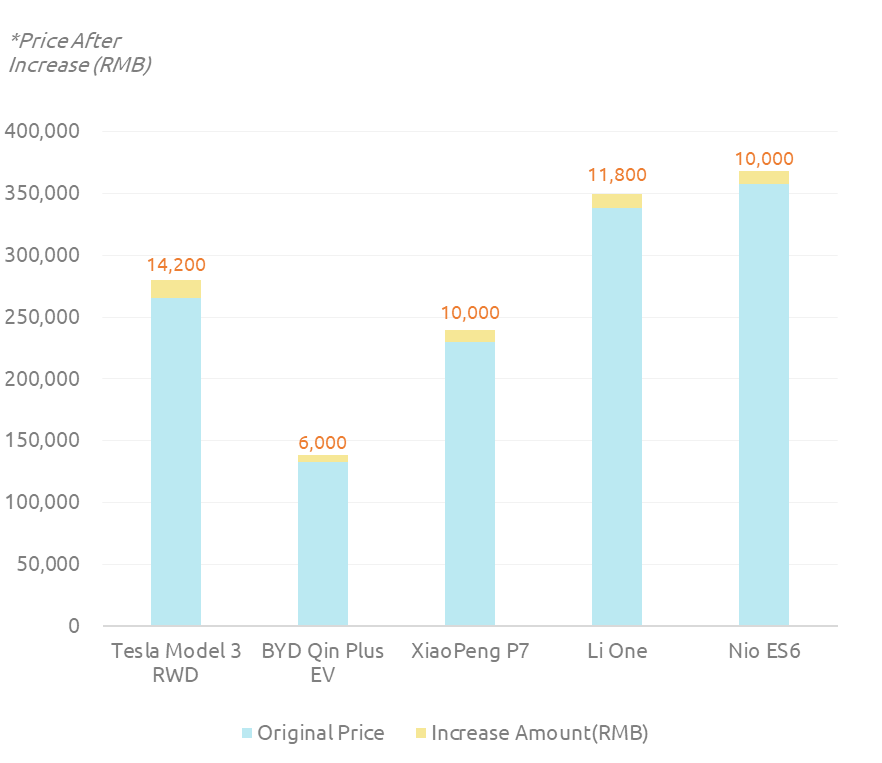

EV companies are also increasing prices to maximize profit as a result of the rising demand. Tesla took the lead in increasing the prices of various Model 3 and Model Y models by RMB 24,000 to RMB 36,000, respectively. Subsequently, from March to April, almost all Chinese car companies raised the listing prices of their models, ranging from 3% to 10%.

Chart: The price increase of selected EVs in China, March-April 2022

The EV shopping experience

While continuously launching new models to meet market demand, the retail landscape of automotive companies has undergone tremendous changes. Traditional car retailing is mainly based on the 4S (Sales, Service, Spare parts and Surveys) shop model.

Consumers for fuel vehicles need to visit stores for purchase. On the other hand, the current mainstream sales model of EVs is to submit orders online, pay deposit to manufacturers to produce models, wait for delivery, and pay the rest to pick up the car.

The process of waiting for delivery can range from 3 months to 6 months. For consumers, putting down a deposit of thousands of yuan is not a big deal. But for manufacturers, there are many more benefits. First of all, the deposit directly withdraws considerable cash flow from consumers, and is conducive to locking customers in advance. Taking BYD as an example, its new model BYD Seal EV, which was launched in May, received 22,637 reservations by the night of the press conference. Based on the RMB 2,000 deposit, the manufacturer received more than RMB 40 million in advance as a deposit on the night of the release. Secondly, the adoption of order-based production allows EV companies to produce on demand after scheduling production plans, reducing the probability of inventory backlog as much as possible.

BYD wins on capacity but Tesla wins on global production efficiency

In terms of the competitive landscape between the leading EV manufacturers in the future, we believe that the key to future success is still the competition for production capacity. Although BYD is ahead of Tesla in sales this time, Tesla is still more competitive in the global market. Firstly, due to a higher degree of automation, Tesla has an inherent advantage in production efficiency. After adopting the integrated die-casting technology, the production efficiency of Tesla Shanghai Gigafactory further improved. The highly anticipated Tesla factory in Austin, Texas and Berlin, Germany have also entered a production ramp-up phase and the production capacity in the second half of the year is likely to rise to a new level.

However, Tesla still faces challenges to catch up with BYD in terms of production capacity. With BYD’s Hefei factory officially put into operation at the end of June and the other seven major vehicle production plants in cities such as Shenzhen, Xi'an and Changsha, BYD will be able to further increase its production capacity. The sales competition between the two BYD and Tesla will be fierce.

Outlook for the second half of 2022

Less dependence on subsidy policy

In April, the Chinese government published a subsidy policy to halve the purchase tax on conventional fuel vehicles to boost the auto market.

Electric vehicles do not enjoy this national subsidy policy, however, though some local governments have introduced regional subsidy policies to stimulate demand for EVs. According to our study, over 50 cities and regions have introduced relevant subsidy policies to promote automobile consumption through cash subsidies, coupons, and lottery draws. Among them, the highest subsidy for new energy vehicles is in Nanshan District, Shenzhen, which can provide 10,000 to 25,000 yuan based on the purchase amount.

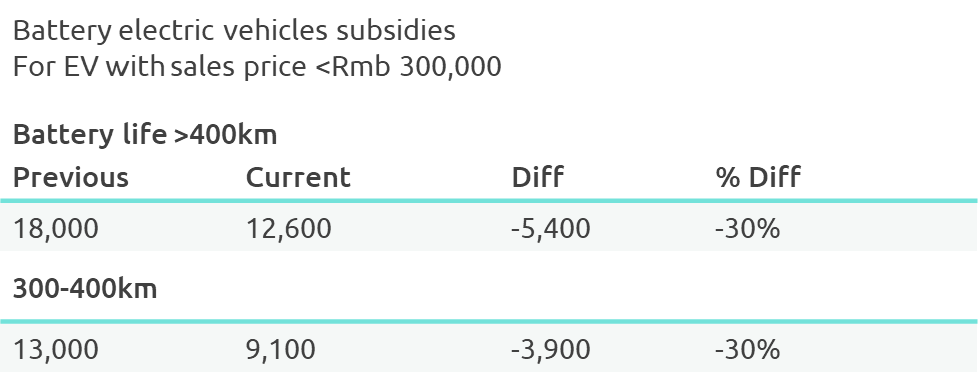

According to the 2021 National subsidy policy for EVs, BEVs with a battery life of 300 km-400 km enjoyed a subsidy of RMB 13,000, and BEVs with a battery life of more than 400 km with a price less than RMB 300,000 yuan enjoyed RMB 18,000 subsidy. In 2022, subsidies for new energy vehicles declined by 30%. Previously, BEVS with a battery life of 300 km- 400 km enjoyed a subsidy of RMB 13,000, but now the government only subsidizes RMB 9,100, reducing the subsidy by RMB 3,900. In addition, the subsidy policy of EVs to be exempted from purchase tax will also expire at the end of 2022. As of now, there is no clear policy signal that the subsidy policy will be continued.

The sales growth in 1H22 has shown that consumers are willing to purchase EV even without government subsidies. In the second half of the year, more EV factories will be put into use, bringing an increase in production capacity. Some key raw materials such as lithium salts are still in short supply and the balance is not expected to improve soon.

Exports may become a new growth point for new energy vehicles

In the first half of 2022, a total of 202,000 EVs were exported, with a YoY increase of 130%, accounting for 16.6% of total vehicle exports. The average export price was $16,700, with a YoY increase of 7.7%. New EV makers such as NIO, Li, Xpeng and others have entered the European market. SAIC, Chang’an, Great Wall, Geely, and Chery have set up factories overseas.

The quality and brand recognition of Chinese automotives have gradually improved, along with its competitive advantage in the supply chain. Due to insufficient production capacity, the automobile inventory is seriously out of stock in rest parts of the world. We believe that in the second half of 2022, the export of China's EVs would deliver a stronger performance.

Both Chinese and global research institutions and automobile industry associations generally predicted that the sales of new energy vehicles in 2022 would be high at the end of last year (Morgan Stanley and CLSA forecasts 4.6 million vehicles; CICC and CAAM forecast 5 million vehicles). We expect sales of EVs to exceed market expectations throughout the year. According to the monthly change pattern, we estimate that the sales of EVs in China will reach 5.5 million in 2022, with a YoY increase of more than 56%.

The pandemic had a significant impact on the Chinese auto market in the first half of the year, but we see the demand side was resilient given the black-swan event on the supply side this year. This would be a key factor for automakers to regain traction for the rest of the year.

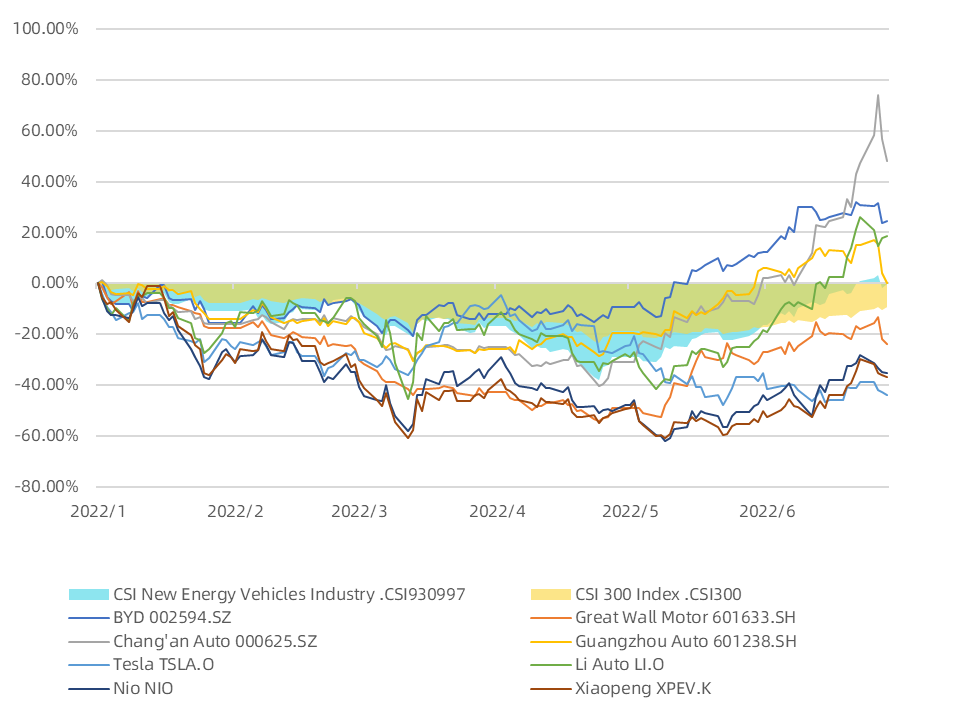

Chart: Valuation table for selected EV companies