What is Deep Learning?

In essence, Deep Learning is a discipline where computers learn to detect and classify patterns, using large-scale neural networks. These networks can contain millions of neurons, much like our own brains, with inputs and outputs. The method is considered “deep” if it possesses multiple structured layers of neurons that contain a wealth of nodes, with extensive, abundant connections.

The success of artificial intelligence that we see today can be attributed to the accessibility of strong computer power, advanced algorithms and the deep pools of data that have allowed deep learning models to further flourish and surpass previous thresholds.

What are some branches of deep learning?

With the help of deep learning techniques, AI researchers have made significant strides in natural language processing (NLP), speech recognition, and image recognition. Computers can now see, hear, and understand human beings, sometimes even better than humans can. Google Translate, which now uses a deep learning neural network architecture, is growing closer and closer to human translation in terms of performance. They have also demonstrated shrewd decision making.

How is deep learning enabling the financial world?

Efficiency

A deep neural network needs to be trained on a large dataset in order for the system recognize patterns effectively with minimal errors. In order to aid effective “learning”, the model needs to be trained with different examples repetitively to achieve a higher level of accuracy. The efficiency that comes with deep learning is the ability of models to “learn” without human intervention, known as unsupervised learning. The algorithms directly draw insights from the data on its own, clustering it, summarizing it, so humans can in turn make data-driven decisions.

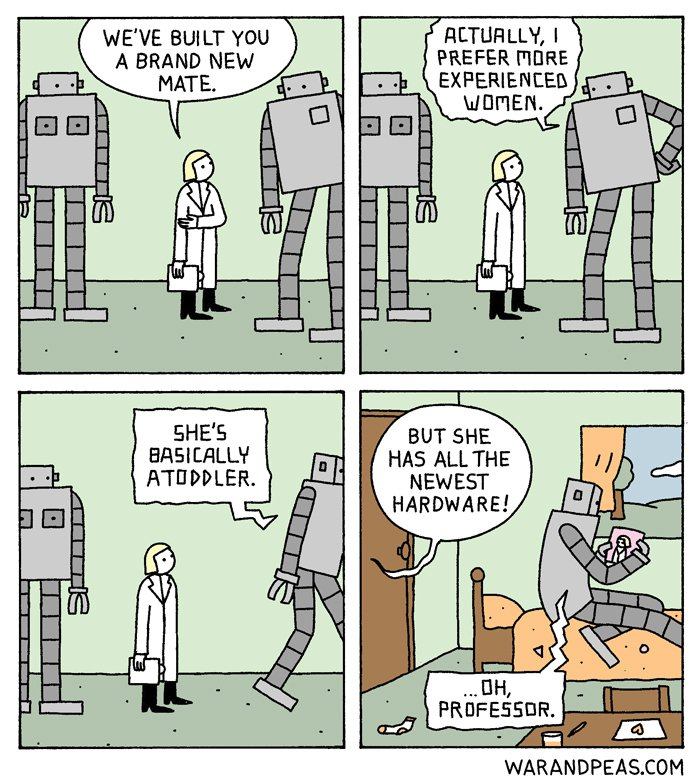

Source: https://warandpeas.com/2017/11/19/born-sexy-yesterday/

Much like how AlphaGo Zero taught itself how to beat all versions of AlphaGo in 40 days, deep learning has the ability to cut down the hours of manual, mundane, repetitive work in the finance sector.

JPMorgan’s COIN program performed 360,000 hours of finance-related work in a few seconds through NLP.

Many analysts listen to quarterly conference calls from corporate management to detect clues that they can use to estimate corporate earnings and build valuation models. If the algorithm succeeds in catching CEOs or management in their mistruths on conference calls, you’ll likely capture alpha by selling those companies when you hold them and avoiding them when you don’t. And technology is still capable of accomplishing so much more.

Deeper Analysis, Better Results

Training such complex models requires a tremendous amount of data, more and more of which has become available in recent years. Deep learning has the ability to aggregate and analyse millions of news feeds, process multitudes of earning statements, crawl a wealth of websites all with the click of button. It also has the ability to autonomously update its models to reflect the latest trends found in new datasets.

One area deep learning has greatly impacted is the veracity of sentiment analysis. It is impossible for the average human, who reads 300 words per minute, to be able to keep up with the 100 articles that might be generated on your portfolio of companies in a minute and, on top of that, providing a sentiment score for each.

While using publicly available information to predict stock performance isn’t new, it’s growing popularity today is due to its abilities to not only crunch a larger amount of data, its also because deep learning has generated more accurate results. More-in-depth analysis provides more accurate inputs for valuation models. With more precise asset pricing, better decisions can be made. Deep learning models like NLP enables portfolio managers to parse through hundreds of thousands of legal documents, business transactions, movements of key entities and events to better evaluate its risk exposures.

All this allows investors to get an edge on the market, make predictions, generate alpha and as an organization, scale more effectively and efficiently.

What are the limitations of deep learning?

While significant progress has been made, there’s more that still needs to be done. Firstly, obtaining large datasets can be difficult. For example, there’s only limited merger and acquisition data to predict whether the deal will be a success. Moreover, deep learning algorithms need to be trained with labelled data. This largely manual process of labelling can require a great amount of human resources which could be prone to error.

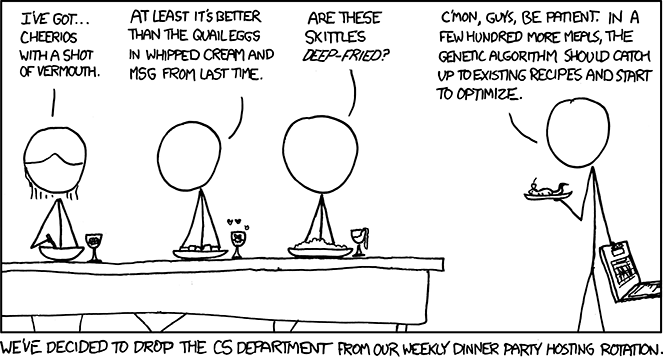

Sources: https://imgs.xkcd.com/comics/recipes.png

Secondly, deep learning is currently restricted in transfer capacities. When the model is confronted with scenarios that are different to the examples it was fed with, the system finds it difficult to classify or contextualise. Especially since financial markets are unpredictable, there are occurrences of black swan events like September 11. This is a complex problem that models as of yet, cannot adapt or preempt. AI models have not yet evolved to handle uncertainty.

Thirdly, and most importantly, deep learning networks remain opaque. They’re black boxes that cannot be opened to shed enough light on its decision processes, especially in situations where the program hasn’t been exposed to before. Between your input and output, there’s many steps you don’t see. The lack of transparency remains a significant hurdle for the adoption of AI tools in financial departments where accountability and reliability are required.

"Deep learning networks remain opaque."

What can humans do?

Powerful fintech comes from the collaboration of powerful fin and powerful tech. The abundance of data poses as both a challenge and an opportunity. Innovative technologies and methods of data analysis will continue to bring about efficiencies and results to any savvy investor. Financial institutions that fail to adopt new technological solutions will lag behind companies who adjust and remain agile, leaving fewer but dominant players.

While the popular debate often surrounds man versus machine, I believe the competition lies more between “AI + HI (human intelligence)” teams. Those investment professionals who train their AI programs well, likely aided by the best in the AI field, will have better odds of outperforming teams that are less successful. The same applies at the institution level.

"I believe the competition lies more between “AI + HI (human intelligence)” teams. "

The adoption of AI is not a walk in the park though. There are a lot of complex problems that AI cannot solve in the finance sector. Deep Learning is just a tool among many tools and future machine learning methods. What is next is for algorithms - to find out things that economists have yet to understand. Can this black box be opened? That’s what is lacking in finance and investment. But that is also the hope. That is where it holds the most promise. Albeit, a challenge, but most certainly, an exciting promise.