It was exactly 10 years ago that the United States economy was on death row. The financial meltdown caused GDP growth to plummet at the fastest rate in over half a century. The stock market tanked, wiping out nearly US$8 trillion in value from 2007 to 2009. Americans suffered the worst, losing US$9.8 trillion in wealth as homes faced devastating devaluations, retirement funds vanished, and the destruction of millions of jobs.

The Federal Reserve and other government agencies were forced to intervene in order to counter what was to be deemed as the deepest financial crisis since the Great Depression. It was only by pumping trillions of dollars to prop up a near-death financial system and the spending of hundreds of billions on fiscal stimulus did the U.S government prevent the shock waves that came with this economic earthquake. Untested and unconventional, the Fed imposed quantitative easing policies, pumping liquidity back into banks, slashing interest rates to zero and buying up government bonds and mortgage-backed securities.

Today, while the effects still leave a scar, the 10th anniversary of the Fed’s bold QE policies have reaped successes. Gradually recovering, the U.S economy is forecasted for a 2.6% growth in 2018 to 2019 and unemployment has lowered from a peak of 10.2% in 2009 to now 3.7%, the lowest in over half a century. With confidence slowly being restored, it’s ushering in a new era of Quantitative Tightening. The Fed is now winding down its US$4.5 trillion balance sheet, making the first move to “normalize” interest rates. The Fed has raised the Fed fund rate three times year-to-date and the fourth one is expected to see by the end of this year.

"With confidence slowly being restored, it’s ushering in a new era of Quantitative Tightening."

On the backs of a stronger green back and yield growth, emerging markets can potentially see pressures from capital outflow as growth grows more attractive in the West. According to the Institute of International Finance, a tracker of international investment flow indicated that emerging markets received negative capital flow for three out of six months from May to October this year. But whilst investors are growing wary of the abilities of developing markets to pay off their debt, a net USD$143.4 billion portfolio still flows to emerging market debts, including foreign and local currency bonds sold by sovereign and corporate borrowers.

So are investments in emerging markets still healthy? Our report looks into the fundamentals of BRICS; Brazil, Russia, India, China, South Africa.

Source: Company Report

In our research, we found the that Russia and China have stronger systems in the areas of government fiscal policies, GDP structure, country leverage and value of currency.

Source: Company Report

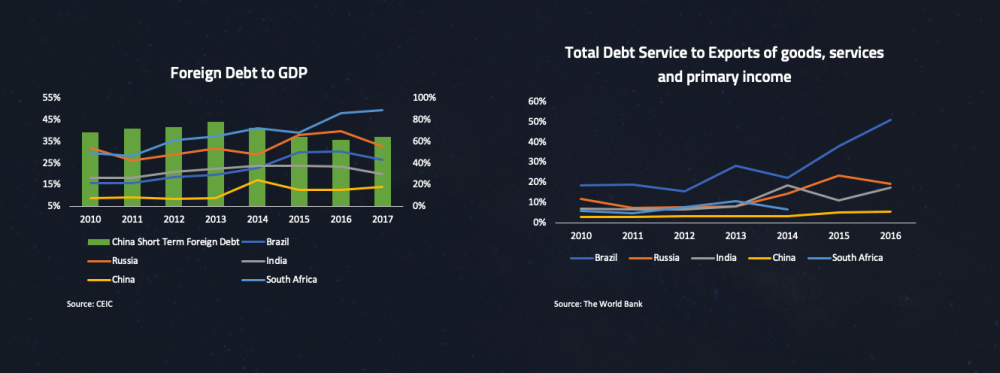

In terms of leverage, while Russia is one of the countries that is most likely to be impacted by wavering investors with over 25% of foreign debt to GDP, the nation had a lower reading than Brazil in total debt service, meaning Russia compared to the South American country has the higher affordability to repay its debts.

Although China had less than 10% foreign debt to GDP, it is important to note that more than half of the foreign debt was short-term with the maturity of one year or less. Therefore, China faces the highest interest rate risk if it rolls over its matured debts. Taking the short-term interest rate risk into account, China’s debt burden was still the lowest among the five. While China’s short-term growth outlook has strengthened, according to the IMF, there is the growing risk of a sharp medium-term adjustment due to reliance on stimulus to meet targets and a credit-expansion path that could be “dangerous”.

Source: Company Report

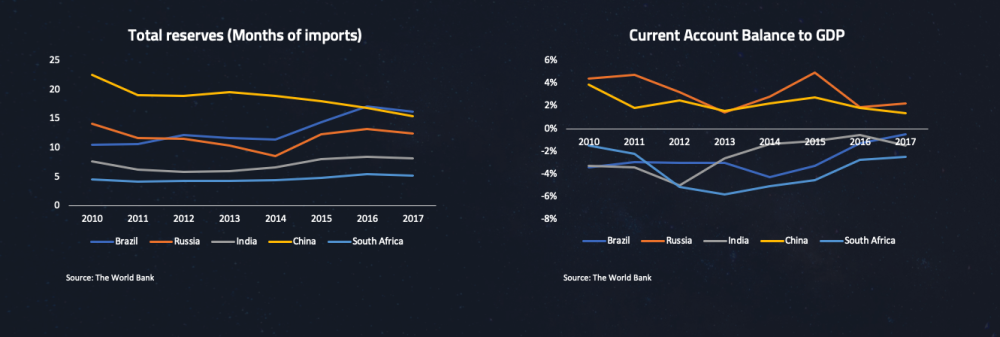

After assessing the current account balance to GDP ratio and total reserves in terms of monthly imports, China and Russia showed healthier statuses, showing better fundamentals in regards to currency value. Thanks to rich deposits of crude oil, Russia’s international reserves remain strong, totalling more than US$460 billion. But since oil and gas account for over 60% of the country’s exports and contributes more than 30% of the GDP, plunging oil prices can greatly affect the economy. International oil prices plunged to the steepest one-day loss on 13 Nov and notched a record streak of 12-day loss in mid-November on the backs of weak demand and oversupply.

For China, risks involved include rising doubts on economic growth and the escalating trade dispute with the U.S. China is facing pressure to strengthen stimulus through fiscal policies, including increasing infrastructure investment and cutting taxes. These measures will hurt the fiscal balance over a period of time.

While there are still reasons to remain optimistic on emerging markets, with uncertainty over how low Chinese growth will go or how far U.S. rates will rise, its best investors brace for potential destabilization when it comes to emerging markets.