HSBC to abandon coal exposure no later than 2040

The asset management arm of global banking institution HSBC is excluding investments in coal-fired power generation and coal mining projects from its actively-managed funds, with a deadline of year 2030 for EU member states and OECD countries and 2040 for all the other states. This follows HSBC AM initially filed such resolution in March 2021.

For the passively managed products tracking an index, the asset manager will ensure a fund’s exposure to coal power and coal mining below 2.5% if the fund does not have either a Paris-aligned goal or a clear divestment pathway.

With a stringent timeline, the policy has allowed for “just transition” that various stakeholders have mulled for. The asset manager will first engage with the invested firms for a transition strategy and only divest those that fail to achieve a consequential transition away from coal businesses.

Biggest sovereign investor asked net-zero goals from investees

Norway’s USD 1.2trillion sovereign investor unveiled a new climate action plan last week part of which requires all the companies in its portfolio of over 9,000 companies to reach net zero emissions by 2050, covering scope 1, 2 and 3 emissions. The Norges Bank Investment Management (NBIM), or oil fund will prioritise the target-setting of companies in the carbon-intensive sectors “as a matter of urgency” before expanding to all the companies by 2040. NBIM will also ask the companies for better disclosure.

The fund has stake in 9,338 companies spanning across 65 countries (regions) by the end of 2021, 1,305 of them in Greater China with a NOK 615bn (USD 5.9bn) in combined value, or 4.1% of its total investment value. In Greater China, the fund invests the most in Taiwan’s chip foundry TSMC by value, followed by Tencent, Alibaba, AIA and Meituan, while by ownership, its 3.77% stake in Vipshop is the heaviest in Greater China.

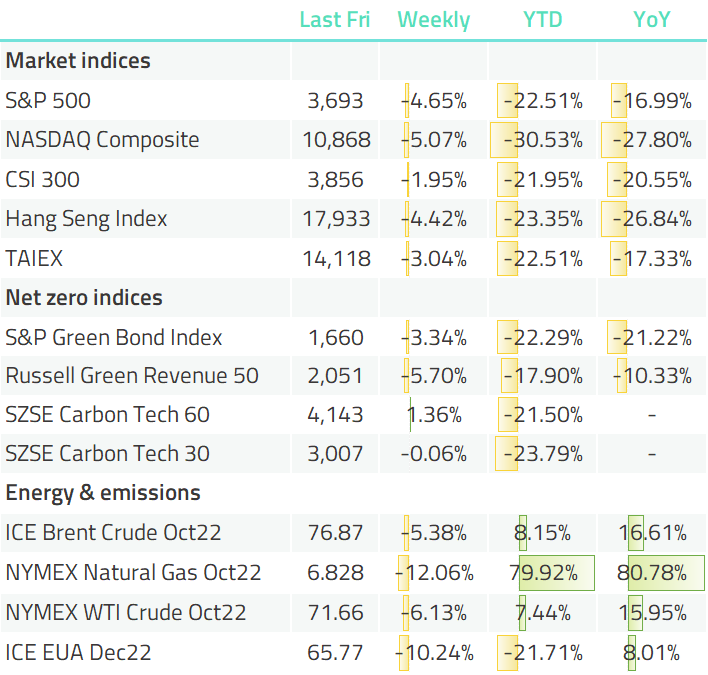

Table: NBIM’s investments in Greater China

McKinsey, BCG double down on sustainability consulting

Last week, management consulting firm McKinsey announced to establish its Global Decarbonisation Hub and Sustainable Materials Hub.

The Global Decarbonisation Hub is set up in Huston, home to the headquarters of multiple energy companies and accounting for 43% of US crude oil production and 25% of US marketed gas production, according to the EIA. McKinsey looks to investing USD 100m in the city in the next ten years for asset decarbonisation projects, according to ESG TODAY.

The Sustainable Materials Hub will aim for better transparency, decarbonisation plans and drive the commercialisation of sustainable materials to make the upstream and downstream needs aligned.

McKinsey has also partnered tech giant Microsoft for an end-to-end solution that helps companies measure their emissions and formulate plans to reduce their carbon footprint.

Another big player in the management consulting field, Boston Consulting Group (BCG) has acquired Quantis, a sustainability transition consultancy that primarily serves companies in food & beverage, cosmetics, fashion and sportswear. This deal will boost BCG’s sustainability consulting capacity with 250 environment experts and transition specialists joining from Quantis.

M&As of sustainability consulting firms have flourished since the beginning of this year, with the most prominent ones being the Irish Accenture that has merged four sustainability/climate consultancies (Avieco, Greenfish, akzente, and Carbon Intelligence) in its public announcements.

Chinese EV startup and its battery supplier launch Hong Kong IPO

Chinese battery maker CALB (03931.HK) will launch the initial public offering on the Stock Exchange of Hong Kong from September 23 to 28, reported Caixin. The firm, ranking only below CATL and BYD in battery production plans to issue 265 million H-shares, each priced between HKD 38 and HKD 51. That is to say the company can raise HKD 10.1bn to HKD 13.6bn (USD 1.3bn to USD 1.7bn) from the IPO in Hong Kong.

The company may raise up to HKD 15.5bn (USD 2bn) if the over-allotment, or greenshoe option is executed.

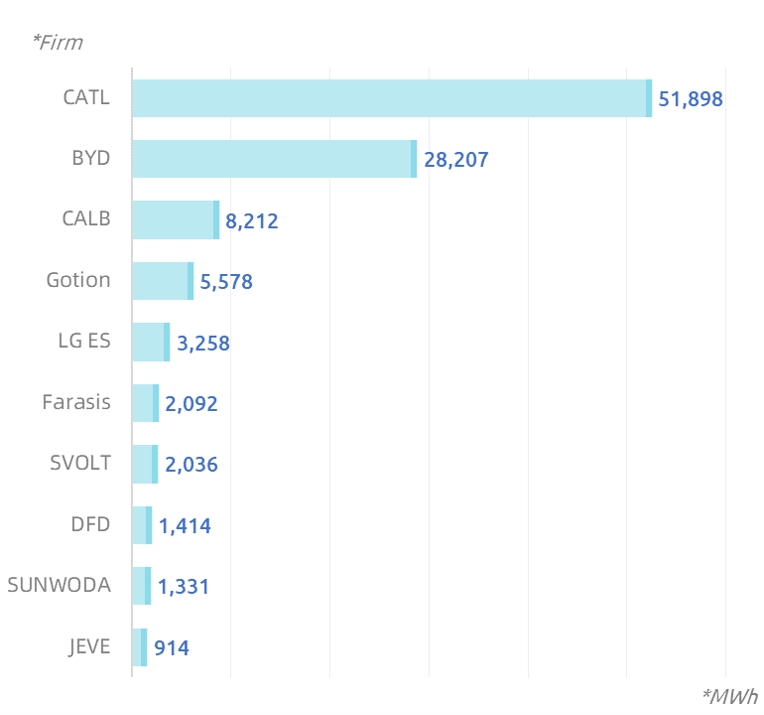

Data from GGII, a think tank, shows CALB comes the third in terms of share in China’s EV battery market. 28,207MWh of its batteries were installed in cars from January to July, most of them were sold to GAC, Xpeng, and Leapmotor.

Chart: Ten largest battery maker in China by total installation (from Jan to Jul 2022)

Speaking of Leapmotor (09863.HK), the Zhejiang, China-based EV startup also launched its Hong Kong IPO last week and is set to raise between HKD 6.2bn and HKD 8.1bn (USD 795m to USD 1bn) and HKD 9.4bn (USD 1.2bn) at maximum if both the offer size adjustment option and the over-allotment option are executed.

This makes Leapmotor the fourth Chinese EV startup to go public in Hong Kong, following NIO, Xpeng and LI Auto. According to the STCN, Leapmotor has completed seven rounds of strategic funding since it was established in 2015, with investors like Sequoia China, state-owed railway equipment supplier CRRC, Shanghai Electric, as well as the Hangzhou, Zhejiang branch of China’s state asset supervision body.

Salesforce launching carbon marketplace, Puro.Earth to pre-sell carbon credits

Customer relationship management solution Salesforce is launching a carbon credit market dubbed “Net Zero Marketplace”. According to the Wall Street Journal, the platform, expected to be online in October will tackle the transparency and quality problems in this market. Salesforce, buying carbon credits since 2017, will offer buyers on the new platform with clarity on the projects and how they can help tackle climate change built on its own experience.

Meanwhile, Nasdaq-backed carbon credit marketplace Puro.Earth has announced to offer prepaid carbon removal certificates, or “Pre-CORCs” linked to early stage decarbonisation projects. According to ESG TODAY, buyers of these certificates will be able to redeem CORCS once the carbon removal is realised and verified by a third party.

Amazon expands renewables portfolio with 71 new projects

Last week, Amazon announced it has invested 71 new renewable energy projects to reach 379 projects across 21 countries (regions), consolidating its title as the world’s largest corporate buyer of renewables.

Once fully in operations, these projects will generate 50,000GWh of clean energy every year, which equals the use of 4.6 million US homes. As of the end of 2021, renewables accounted for 85% of the energy use across Amazon’s business.

World Bank president under pressure to resign for climate change stance

David Malpass, the president of World Bank, avoided giving a clear answer three times when being asked whether he accepted climate change is caused by human activities at an event in New York last Tuesday. Malpass only said he was “not a scientist” to end it. According to the Financial Times, US and German officials and some environmental organisations were left unsatisfied with such claim and asked Malpass to resign.

Malpass attempted to compensate for what he did. In an interview with CNN last Thursday, he said it is clear that greenhouse emissions were caused by man-made sources and he was not a “denier”.

Malpass was appointed by former US president Donald Trump and his current term ends April 2024.

Boeing fined USD 200m over misinformation on 737 Max accidents

Airplane manufacturer Boeing has agreed to pay USD 200m in penalty to

settle the charges by the US Securities and Exchange Commission that the company was misleading investors about two deadly accidents of its 737 Max model in 2018 and 2019.

Its former CEO Dennis Muilenburg will pay an additional penalty of USD 1m himself. Upon the 2018 accident in Indonesia, Muilenburg suggested not to mention software update in the company’s press release on that matter, and asked employees to include the part of investigation report by the Indonesian government that “selective highlighted” pilot’s misconduct and poor maintenance of the plane as reasons of the accident. He was dismissed by Boeing in December 2019.

PwC welcomes new Global ESG Leader

Last week, professional services firm PricewaterhouseCoopers (PwC) announced the appointment of Will Jackson-Moore as its Global ESG Leader. According to his LinkedIn profile, Jackson-Moore has been working in PwC since leaving university in 1990. His latest role before this appointment was Global Private Equity, Real Assets and Sovereign Funds Leader.

HSBC adds three new senior hires in sustainability unit

According to Reuters, HSBC has announced three new hires to its sustainability business:

Justin Wu will be the bank’s Co- Head of Climate Change Asia Pacific. Wu has worked in Bloomberg New Energy Finance (BNEF) for over 15 years, most recently as Head of Asia Pacific. He will be based in Tokyo before relocating to Hong Kong in mid-2023.

Milo Sjardin will be Managing Director, Head of Climate Analytics, who has worked in Bloomberg LP and its affiliate BNEF for over 15 years, most recently as the Director of Research at Bloomberg Intelligence.

Susannah Fitzherbert-Brockholes will be Director of Sustainable Finance. Prior to this appointment, Fitzherbert-Brockholes worked in PwC for nearly ten years, most recently as Assistant Director. During that time, she spent two years in the Climate and Development Knowledge Network (CDKN) led by PwC.